Appraisal

- By Admin

- October 23, 2014

- Comments Off on Appraisal

In most cases, lenders require a professional, independent appraisal of the property you want to buy or refinance to ensure that it is worth at least as much as they … Continue Reading →

Interest Only Mortgage

- By Admin

- August 28, 2014

- Comments Off on Interest Only Mortgage

Interest-Only Loans are a relatively new loan program. Before the 2007 financial meltdown, it was favored by property buyers looking for the lowest monthly installments, because interest-only mortgages, as the name … Continue Reading →

What is a Home Equity Loan?

- By Admin

- June 17, 2014

- Comments Off on What is a Home Equity Loan?

What is Home Equity? Home Equity is the portion of the house value a homeowner actually owns. It is the value of the house minus any liens and mortgages. In … Continue Reading →

Reverse Mortgage and HECM

- By Admin

- May 28, 2014

- Comments Off on Reverse Mortgage and HECM

A reverse mortgage is a type of home loan that lets you turn a part of the equity in your home into cash. The most popular reverse mortgage program is the … Continue Reading →

Condominium Mortgage More Difficult to Get?

- By Admin

- October 30, 2013

- Comments Off on Condominium Mortgage More Difficult to Get?

Condominium buyers seem go through a more stressful mortgage process than single family homebuyers. This is due to the fact that, in addition to the loan borrower being scrutinized, the … Continue Reading →

JPMorgan Said To Be Fined $13 Billion In Toxic Mortgage Bonds Sale

- By Admin

- October 23, 2013

- Comments Off on JPMorgan Said To Be Fined $13 Billion In Toxic Mortgage Bonds Sale

JPMorgan Chase & Co, America’s largest bank by asset, is said to have reached a $13 billion deal with the Department of Justice for its role in selling toxic mortgage … Continue Reading →

HELoan vs HELOC

- By Admin

- October 18, 2013

- Comments Off on HELoan vs HELOC

Home Equity Loan and Home Equity Line of Credit (HELOC) are mortgages which use a house as collateral. Unless there is currently no mortgage on the house, home equity loan … Continue Reading →

What is Annual Percentage Rate (APR)

- By Admin

- October 11, 2013

- Comments Off on What is Annual Percentage Rate (APR)

There are many costs associated with taking out a loan. The interest rate is one of those costs. There are also charges, such as application fee, underwriting fee, and points … Continue Reading →

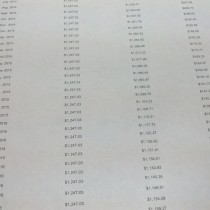

Loan Amortization

- By Admin

- September 30, 2013

- Comments Off on Loan Amortization

Amortization is a fancy way of describing the process of paying off a loan in equal installments over a period of time. When a loan is calculated to be paid … Continue Reading →